‘Old’ world economies charge higher inheritance and estate taxes than the ‘new’ worldStealth taxes make passing on a family home more expensive than handing on a cash sum

![]() The UK and Ireland take the highest proportion of inheritance or estate taxes of any major world economies, according to a new study by UHY, the international accountancy network.

The UK and Ireland take the highest proportion of inheritance or estate taxes of any major world economies, according to a new study by UHY, the international accountancy network.

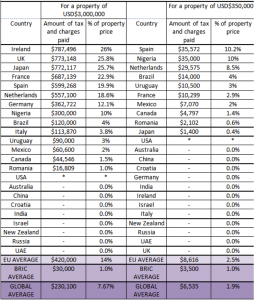

Ireland would typically take 26%, and the UK 25.8% from the estate of an individual passing on an estate worth US$3m* to their heirs, well above the global average of 7.67%. For UK individuals that have never been married, the amount of inheritance tax taken from their estate would be even higher at 32.9%.

The study also found that European countries generally levy the highest inheritance taxes of all, with EU countries in the study taking 14% tax on the inheritance of a property of US$3million, nearly twice as much as the global average of 7.67%. However, on a lower value property worth US$350,000, the difference is narrower, with European countries taking on average 2.5% in inheritance or estate tax, compared to a global average of 1.9%.

UHY explain that emerging economies have traditionally not imposed inheritance and estate taxes because inheritance taxes are sometimes seen as discouraging wealth creation and because many emerging market economies have tried to keep their tax systems relatively simple. For example, China, India and Russia all have no inheritance taxes.

Several developed countries, including Australia, Israel and New Zealand, have chosen to abolish inheritance taxes in order to create simpler tax systems and encourage the creation of wealth, whether through investment or entrepreneurship.

Ladislav Hornan, chairman of UHY, says: “Many emerging economies are especially keen to encourage wealth creation, and very low, or no, inheritance tax is seen as an important way to do that. Not only are individuals more incentivised to earn more in order to pass it on to the next generation, but inheritances are themselves often a crucial source of funding for new businesses, especially in countries where there is less bank finance available.”

“In established European economies, by contrast, Governments are becoming increasingly reliant on the substantial income streams generated by inheritance tax. It can also be seen as a way of creating tax revenues from ageing populations: retirees frequently have lower levels of taxable income, but substantial assets such as mortgage-free homes”

“Emerging markets economies, with their much more youthful populations, have no pressing demographic reason to need an inheritance tax. Even as they become older and wealthier, they should resist the temptation to introduce them as they could act as a brake on future growth.”

Level of inheritance tax threshold crucial issue for middle class families

UHY explain that the level at which inheritance tax thresholds are set is a crucial issue for middle class families. If thresholds are not adjusted in line with inflation, it can mean that taxes, that were originally designed to apply only to the very wealthy, start to affect a larger proportion of the population.

UHY note that in the USA, the 40% federal estate tax applies only to estates of over $5.34m, and so only affects those with substantial assets. Moreover, the US has raised the threshold for paying the estate tax several times over the last decade, increasing it to its current level from$1,500,000 for deaths in 2004 – 2005.

By contrast, in the UK, the inheritance tax threshold has been frozen at £325,000 (US$ 544,862) since 6 April 2009 and is expected to remain at the level until at least 5 April 2018. This is actually below the average London house price of £409,881 (US$686,058), and not far above the UK average house price of £250,000 (US$418,450).

In Japan, the Government has taken steps to lower the threshold at which inheritance taxes start to apply, with the result that more families are caught by the tax.

Ladislav Hornan, Chairman of UHY, comments, said: “Inheritance tax has become a big earner for the UK Treasury, and inevitably, as rocketing house prices push more and more people into its scope, the amount of tax planning going on is increasing.”

“The Government of course recognises that most people would rather the taxman does not get his hands on their money, so there are specifically targeted investment reliefs from inheritance tax which encourage older people to continue to invest productively, rather than simply to spend their wealth, by making investments in unlisted trading company shares.”

“In the UK, as in many other countries, there are gifting exemptions that allow individuals to pass on wealth while they are still alive, so that inheritance tax can be mitigated entirely if an individual makes gifts to their heirs at least seven years before their death.”

“In Japan, tax payers already make very extensive use of these exemptions, and the plans to lower the inheritance tax threshold there from next year has prompted a new wave of interest in the gifting rules.”

“Some would prefer developed economies like the UK and Japan to follow the example of Australia, where the system has been vastly simplified by the abolition of inheritance tax, or at least to start to wean themselves off the tax by increasing the threshold at which it is paid in a meaningful way, as has been the case in the USA.”

Rick David, Chief Operating Officer of UHY Advisors, member of UHY in the USA, said: “Americans regularly complain about estate taxes, but with the current high threshold for the federal taxes the great majority of estates will escape such taxation. This provides a powerful incentive for middle class Americans to continue to invest and earn, even into late life, because they know they will be able to pass most of what they have onto their children and grandchildren.”

“State level taxes are another matter, and while a majority of the states do not impose an estate tax, many retirees consider the existence of such taxes when selecting a retirement location. Certain states, such as Florida, increase their attractiveness when consideration of such taxes is part of their analysis. With the anti-tax movement continuing to gain ground in the USA, we may well see more states weaken or scrap their estate taxes.”

*Property price of £1.79million / EUR2.16m. Calculations based on a passing on a home to two adult, non-dependent children. Where taxes are levied on a state / local level as in USA, Brazil, Spain, Mexico and Canada, a national average has been used. No special allowances such as Italian exemption for acquiring a first home apply.